RECOMMENDATION OF SUBPRIME MORTGAGES FROM POLICY RECOMMENDATION

Subprime mortgages were the primary trigger of recent events. Browse Get Results Instantly.

Consumer Action Questions Answers About Subprime Lending

2022 Federal Homeowner Relief Program is Giving a One Time 3627 StimuIus Check.

. At Fern Fort University we write Betting on Failure. We note the following policy recommendations. Several major financial institutions collapsed in September 2008 with significant.

Financial Policy Committee consult on withdrawing mortgage affordability test 28 Feb 2022 by Tom Daldry Shard Financial Media In 2014 the Financial Policy Committee FPC introduced two recommendations to protect against a loosening in mortgage underwriting standards and a material increase in household indebtedness which would enhance. While not exhaustive the following lending standards. Congress should simply outlaw adjustable-rate mortgages which basically ask borrowers to treat their home mortgages like stocksCongress should also ban private lenders and brokers from issuing sub-prime loans of any kind.

Subprime mortgages also tend to have higher fees than other mortgages ranging from 2 to 3 of the borrowed amount. A subprime lending policy should be appropriate to the size and complexity of the institutions operations and should clearly state the goals of the subprime lending program. Banking institution also has to optimum amount and mix of.

A subprime mortgage is issued to consumers with low credit ratings usually below 640. However that initial shock both. Sustainable subprime mortgage products and services.

This limits the number of mortgages that can be extended at LTI ratios at or greater than 45. Project Goals yIdentify the major factors contributing to the rise of mortgage foreclosures. If properly implemented the recommendations of the report of the Presidents Working Group on Financial Markets should go a long way toward preventing financial crises like the current subprime.

Diagnosis and Summary of Recommendations Diagnosis The global market turmoil has not yet abated so any diagnosis is necessarily incomplete. YInvestigate the economic impact of the current mortgage foreclosure crisis. The following section provides a summary of the final set of funding recommendations agreed upon by the Task Force guidance for administering agencies and a record of policy recommendations that were discussed.

This Policy defines subprime and nontraditional residential mortgage loans as it applies to the Banks private label MBS portfolio but all limitations restrictions and reporting requirements regarding the MBS portfolio are contained in other Bank policies. In many ways the optimists were correct but now less than fifteen years later the subprime mortgage market is collapsing threatening to take the rest of the housing sector along with itSubprime Mortgages. Thus people will pay mortgages and the next 100 years of We are concerned that yields from sub-prime or Low rainfall river flow and dam storage will reflect the past Security water entitlements will remain low or decline in 100 years.

By Tyler Cowen December 21 2007 at 521 am in Economics. Learn from subprime mortgage crisis and require registration and duty of care of brokers o. FindResultsNow Can Help You Find Multiples Results Within Seconds.

YAssess the effectiveness of current federal and state programs to reduce the number of foreclosures. Profiting from Defaults on Subprime Mortgages. The banking industry has some strict rules and regulations regarding its capital and other reserves.

Upon guidance for developing recommendations as well as the foundational framework upon which this process operated. Check Your Eligibility Today. The subprime mortgage crisis has taken its shape from the year 2006 when the well known investing firms of United States ease their lending norms for providing loan to sub- prime customer low income group people for buying real estate property.

Being the most significant financial institution banks need to maintain its capital requirements all the time according to the laws policies and rules set by federal reserve or central bank and the government. Funds mortgage originatorslenders and the mortgage backed security sponsors are primarily responsible for the current subprime credit crisis. Just as with subprime mortgages brokers before 2008 small business brokers have the financial incentive to steer borrowers into the most expensive loans.

Profiting from Defaults on Subprime Mortgages case study recommendation memo as per the Harvard Business Review Finance Accounting case memo framework. The average interest rate on a subprime mortgage tracks 1 to 3 higher than standard mortgages and lenders usually require at least a 15 down payment. The life of the loan is usually fairly short in comparison to standard.

ET today after the company appointed a new CEO and also provided some guidance on its full-year results. The first recommendation was the loan to income LTI flow limit. Profiting from Defaults on Subprime Mortgages case study is a Harvard Business School HBR case study written by.

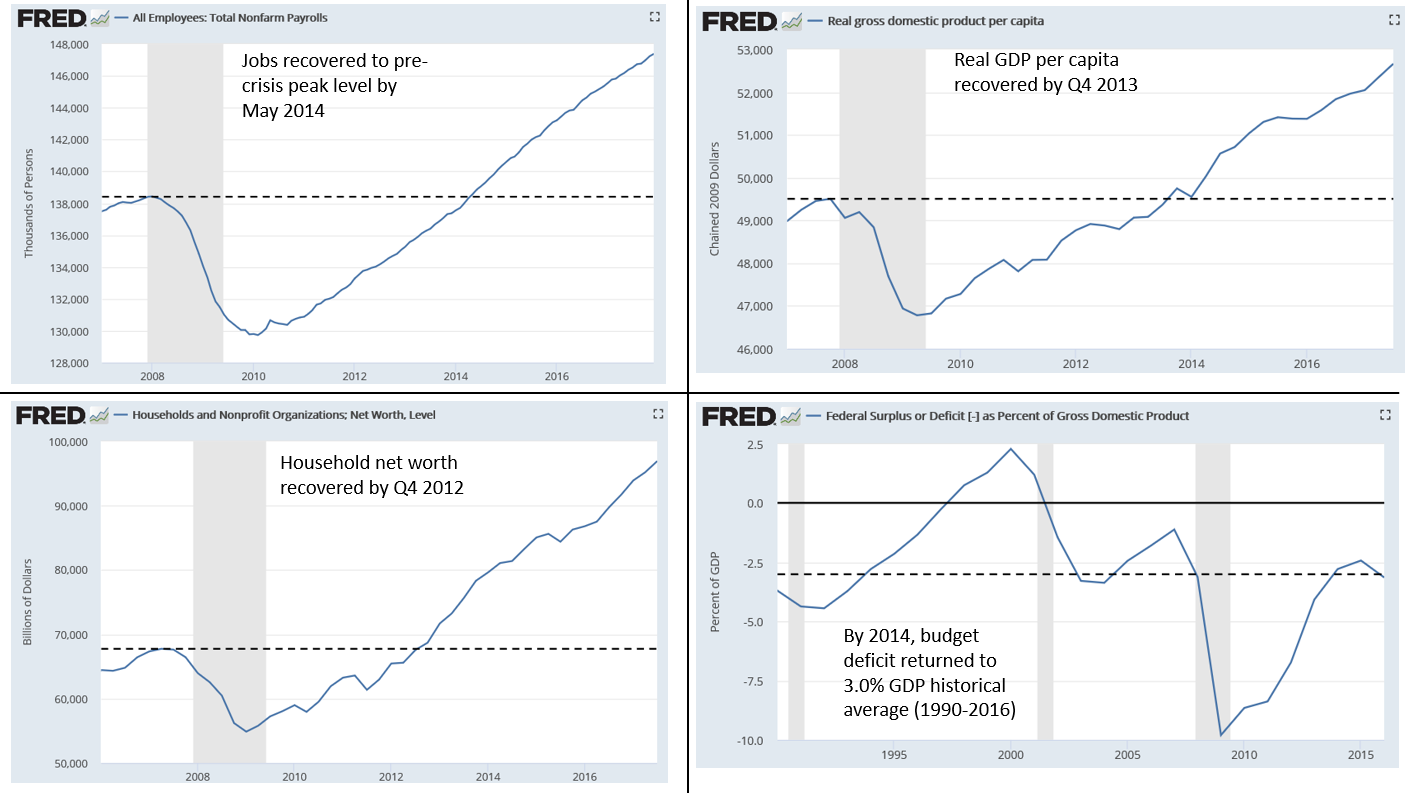

Subprime mortgages were one of the primary drivers of the financial crisis that led to the great recession. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. At EMBA PRO we provide corporate level professional Marketing Mix and Marketing Strategy solutionsBetting on Failure.

The input was used to craft a set of policy recommendations on the future of subprime lending practices. It was characterized by a rise in subprime mortgage delinquencies and foreclosures and the resulting decline of securities backed by said mortgages. The second recommendation was the affordability test which allows mortgage lenders to see a stress interest rate when assessing prospective borrowers ability to repay.

Ad Search For Info About Subprime mortgage lenders. Require small business brokers to register with the State and disclose to. There are several types of subprime mortgages such as fixed-rate adjustable-rate interest-only and dignity mortgages.

Americas Latest Boom and Bust analyzes how the subprime market emerged why it is in crisis and how we can reform public policy to. These recommendations will be submitted to the full Presidents Advisory Council on F. And a fuller discussion of policy issues and recommendations.

Seasoning of staff and loans should be taken into account as performance is assessed over time. YFormulate a series of public and private sector policy recommendations to stem the flow of. EMBA Pro Case Memo Recommendation Memo Approach for Betting on Failure.

Case Study Recommendation Memo Assignment. Subprime mortgage crisis was a set of events and conditions that led to a financial crisis and subsequent recession that began in 2007. Shares of the subprime lender OppFi OPFI -1012 had fallen more than 10 as of 1 pm.

Subprime policy recommendations.

What Is A Subprime Mortgage Your Credit Score Is Key

3 Default Rates On Subprime Mortgages Download Scientific Diagram

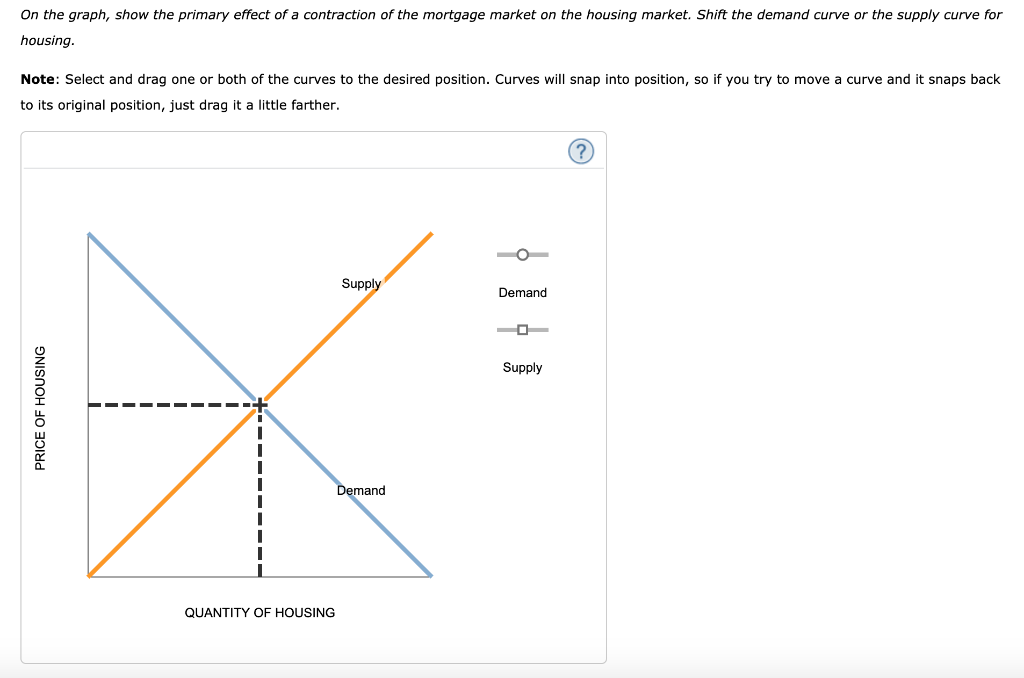

The 2008 Housing Crisis Center For American Progress

Subprime Lending Drives Spending Seeking Alpha

Education Where Should I Look To Find Statistics On The Share Of Subprime Mortgages To Total Mortgages

Subprime Mortgage Crisis Wiki Thereaderwiki

Solved 4 The Subprime Mortgage Market The Financial Crisis Chegg Com

0 Response to "RECOMMENDATION OF SUBPRIME MORTGAGES FROM POLICY RECOMMENDATION"

Post a Comment